The stock market’s recent rally is “fragile” due to the potential for further downward earnings revisions heading toward 2023, according to RBC Capital Markets.

Forecasts for revenue and earnings per share, or EPS, have started to decline for the second half of this year and 2023, although company results for the second quarter have come in “much better than expected,” said Lori Calvasina, head of U.S. equity strategy at RBC, in a research note Wednesday.

While earnings “resilience” seen after more than half of the S&P 500’s results were in for the second quarter is “good news” for the U.S. stock market, she said the “bad news” is the risk of further downward earnings revisions later this year.

As companies began reporting second-quarter earnings, “many U.S. equity investors were hoping the ‘Band-Aid would get ripped off’,” wrote Calvasina. That is, “that company guidance and EPS forecasts on the sell-side would get cut dramatically, fully bake in an economic slowdown, and allow them to start buying stocks with some confidence about where multiples are really at.”

Read: Did the stock market peer through ‘rose-colored glasses’ as tech surged in July?

The S&P 500 was down almost 13% so far this year based on Wednesday afternoon trading at around 4,161 according to FactSet data, at last check.

According to the RBC report, much stronger-than-expected results for the second quarter have “painted a picture of resilience for corporate earnings and supported the narrative that any coming (or current) economic downturn is likely to be short and shallow.”

Read: Most U.S. businesses grow faster in July, ISM finds, in sign of resilient economy

“That’s been supportive of stock prices over the past few weeks, but going forward it also tells us that the rally in stocks is fragile given the possibility of further downward earnings revisions as 2023 comes into view,” said Calvasina. “Forecasts are coming down, but perhaps not enough.”

Meanwhile, companies beating on EPS in the second quarter are “being rewarded with some stronger than usual outperformance, and companies that are missing are benefiting from shallower than usual underperformance,” she wrote.

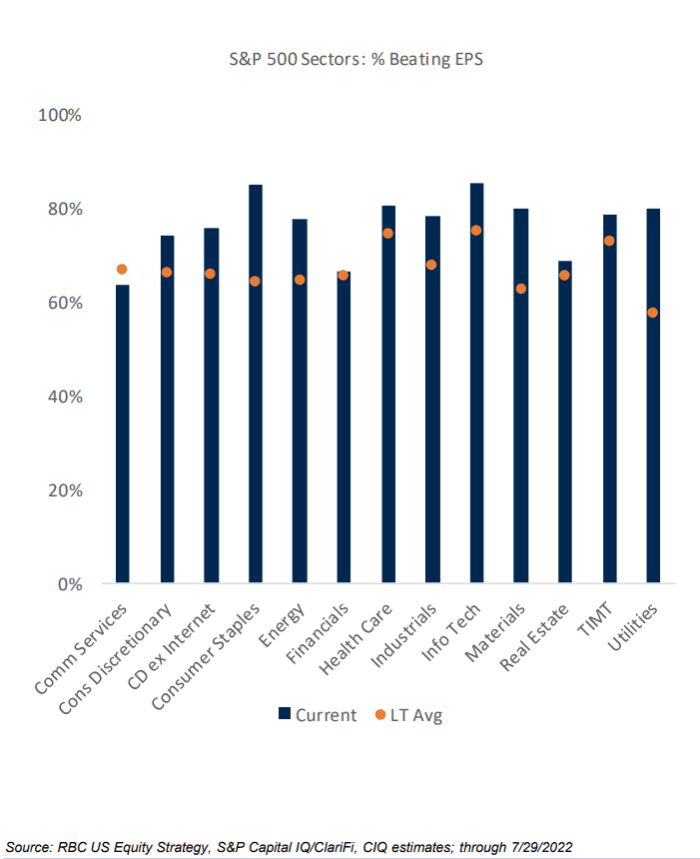

Sector “standouts” so far include energy, real-estate investment trusts and utilities for earnings resilience, with all three areas helping to keep 2022 EPS growth forecasts from “falling too much” for the S&P 500, according to RBC. Technology also stands out, as it’s a sector “where earnings sentiment has already been deeply negative and beat rates have been high” for the second quarter, said Calvasina.

“On the flip side, tech has seen one of the highest percentages of negative revisions on both earnings and sales, along with consumer discretionary and communication services,” said Calvasina.

Read: Semiconductor ETFs close mixed amid fears of an industry ‘down cycle,’ Pelosi trip to Taiwan

RBC has a “technology overweight as a recession rebound trade,” and recently upgraded energy to overweight and REITs to market weight, according to the note.

U.S. stocks were trading sharply higher Wednesday afternoon, with investors digesting earnings reports and fresh economic data showing factory orders continue to grow in June as the economy decelerates.

The Dow Jones Industrial Average DJIA, +1.29% rose 1.5% in afternoon trading Wednesday, while the S&P 500 SPX, +1.56% gained 1.8% and the tech-heavy Nasdaq Composite COMP, +2.59% jumped 2.7%, FactSet data show, at last check.

“We’ve also been keeping an eye on the labor discussion, where a number of tech firms have highlighted a slowdown in hiring,” said Calvasina. “Outside of tech, however, the conversation about labor still seems to emphasize the challenges companies have finding it.”

from Stock Market News – My Blog https://ift.tt/Hx8ZGdn

via IFTTT

No comments:

Post a Comment