Markets saw a selloff after a cataclysm of bad data, including the highest inflation in four decades, coupled with disappointing big bank earnings left investors repricing equities.

For the week, the Dow edged 0.2% lower, the S&P500 lost 0.9%, and the Nasdaq Index declined 1.6%.

The recent inflation numbers and a miss in earnings have only led to growing fears of a recession, with the yield curve inverting and oil falling to $97 a barrel.

The week ahead is packed with earnings and housing data, likely determining where the markets head next.

For a complete list of major events and stock market updates check out our economic calendar’.

While many economists had forecasted a modest increase in Inflation in June, CPI data showed that inflation had surged to 9.1%.

Furthermore, a 1% gain in June retail sales, coupled with a strong job market, now means that the Fed may take drastic measures to tame inflation.

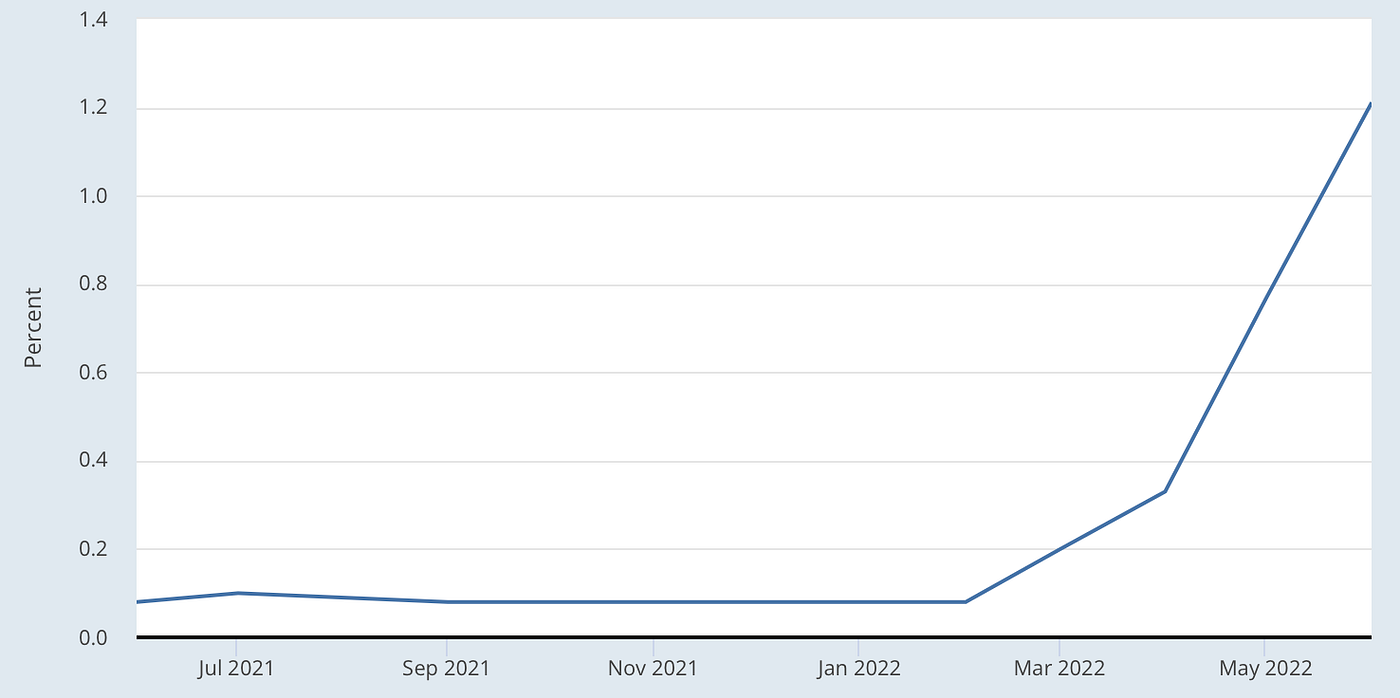

Recent Comments from the fed have led strategists to price in a 50% chance of a 100 bps rate hike compared to the previously 92% chance of a 75 bps hike.

As a result, the yield curve has inverted, with the 2-year rate at 3.15%, compared to 2.92% for the long term, indicating that a recession coming.

The week ahead is packed with second-quarter earnings with Big Banks Bank of America and Goldman Sachs reporting on Monday, followed by Healthcare Giants Johnson & Johnson and Novartis on Tuesday.

Furthermore, high-profile earnings from AT&T and Netflix are expected throughout the week. While companies have historically beat earnings 65% of the time on average, this quarter will likely mark a turn for the worse. An additional important stock with earnings this week is Tesla.

A triage of issues, including inflation, slowing consumer demand, and supply chain shortages, will likely mean that the second quarter will be filled with misses and downward revisions for the next quarters.

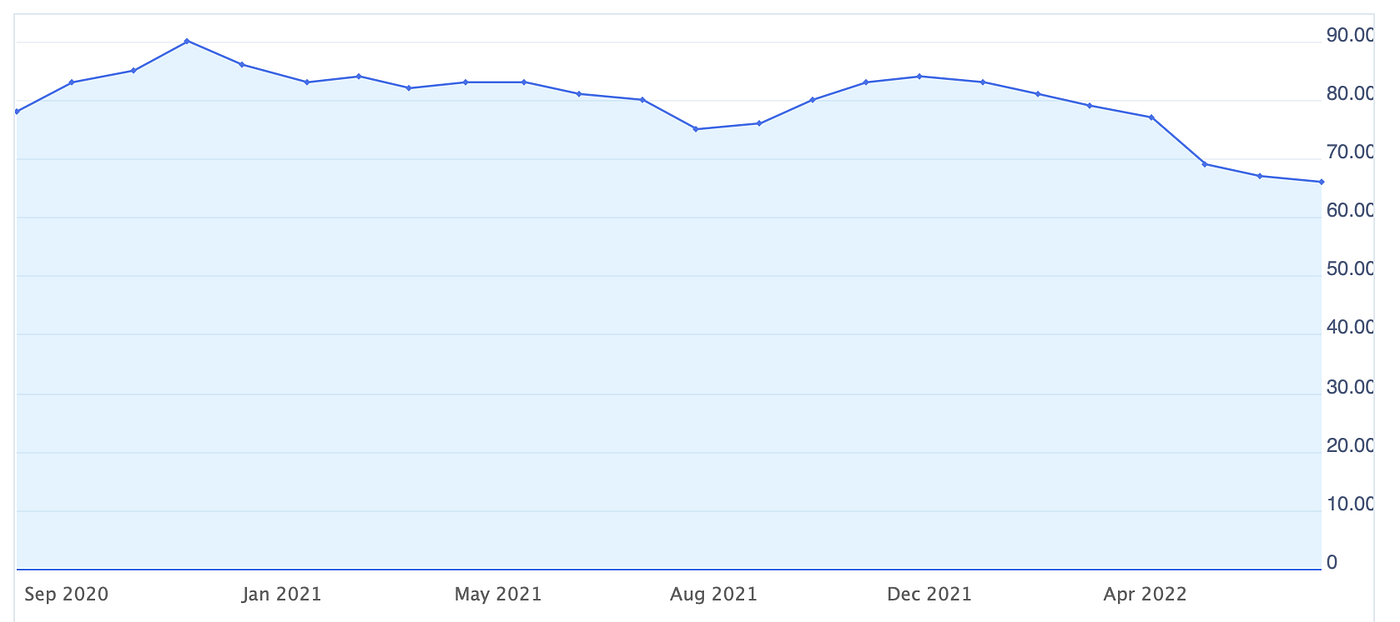

A host of housing data will show the state of the market, which has struggled in recent weeks due to skyrocketing mortgage rates.

The index has fallen sharply recently, from a high of 84 in December 2021 to 67 in June. The National Association of Home Builders is set to report the Housing Market Index in May for July.

This will be followed by data from the US Census Bureau, which will report housing starts and building permits for June.

Housing starts have plummeted from the pandemic era high of 1.81 million to 1.58 million in June, as higher mortgage rates, soaring commodity prices, and record inflation lead to lower demand.

from NYSE Updates – My Blog https://ift.tt/kocJxLi

via IFTTT

No comments:

Post a Comment