Torsten Asmus/iStock by way of Getty Photos

Market Recap

Right here we go once more, down that’s, the S&P 500 had its second worst month this 12 months and completed June with a lack of 8.25%, as measured by SPY. My watchlist didn’t carry out any higher as the ten chosen shares for June misplaced a collective 10.24%. Nevertheless since inception, November 2020, the watchlist stays 4.58% forward of SPY. My different benchmark, VYM, additionally had a awful June shedding 7.86%, it did carry out significantly better than the watchlist and stays 4.35% forward since inception. SPY is down 19.98% this 12 months by month-end June, my watchlist is performing significantly better with a lack of solely 13.81% however it trails VYM that’s down simply 7.97%.

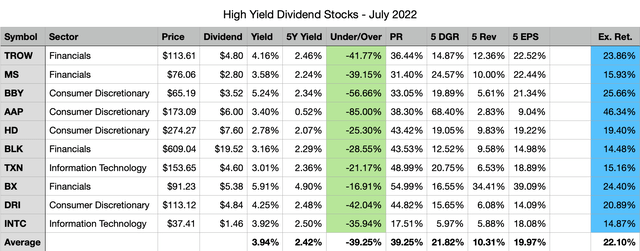

The primary goal of a excessive dividend yield portfolio is to not outperform the broad market however to generate a passive revenue stream that’s protected, dependable, and one that may develop sooner or later. The highest 10 shares on my watchlist for July 2022, collectively, provide a 3.94% dividend yield that’s greater than double the dividend yield of the S&P 500. Additionally it is considerably higher than the dividend yield of VYM that hovers round 2.5%. These 10 shares have additionally grown their dividends at a historic fee of 21.82% per 12 months over the past 5 years. Collectively, all 10 shares look like probably about 39% undervalued proper now based mostly on dividend yield principle.

The easiest way to create a robust excessive yield dividend portfolio is with a buy-and-hold technique. This technique forces you to consider the shares you determine to take a position your capital into because the plan is to carry the positions indefinitely. Making use of this strategy over the long run whereas specializing in probably undervalued shares, permits traders to generate alpha by capital appreciation. Whereas this will not pan out for each place, diversifying your high-yield portfolio throughout 20 or extra distinctive shares will enhance the percentages of selecting up shares of sure shares when they’re buying and selling for discount costs. The fantastic thing about a long-term outlook is time; you’ll be able to sit again and anticipate the valuation to revert to historic norms, all of the whereas amassing a beneficiant passive revenue stream.

Watchlist Standards

Creating the excessive yield watchlist, I had 4 areas of curiosity that I centered on: fundamental standards, security, high quality, and stability. First off, the fundamental criterion goals to slender down the checklist of shares to those who pay a dividend, provide a yield above 2.75%, and commerce on the NYSE and NASDAQ. The subsequent set of standards focuses on security as a result of that could be a essential a part of a excessive yield investing technique. The filter excludes corporations with payout ratios above 100% and corporations with unfavorable 5-year dividend development charges. One other stage of security may be related to bigger corporations; due to this fact, the watchlist narrows in on shares with a market cap of a minimum of $10 billion. The subsequent set of standards got down to slender down the checklist to incorporate larger high quality companies. The three filters for high quality are: a large or slender Morningstar moat, a regular or exemplary Morningstar stewardship, and an S&P high quality ranking of B+ or larger. A Morningstar moat ranking represents the corporate’s sustainable aggressive benefit, the primary distinction between a large and slender moat is the length that Morningstar expects that benefit to final. Corporations with a large moat are anticipated to keep up their benefit for the subsequent 20 years, whereas corporations with a slender moat are anticipated to keep up their benefit for the subsequent 10 years. The Morningstar stewardship evaluates the administration staff of an organization with respect to shareholders’ capital. The S&P high quality ranking evaluates an organization’s earnings and dividend historical past. A ranking of B+ or larger is related to above-average companies. The final set of standards focuses on the steadiness of an organization’s top-line and bottom-line development. The filter eliminates corporations with unfavorable 5-year income or earnings per share development fee. I consider an organization that’s rising each their top-line and bottom-line has the flexibility to offer development to its traders sooner or later.

The entire shares that cross the preliminary screener standards are then ranked based mostly on high quality and valuation. Additional, I kind the shares in descending order based mostly on one of the best mixture of high quality and worth and choose the highest 10 shares which are forecasted to have a minimum of a 12% annual long-term return.

July 2022 Watchlist

Right here is the watchlist for July 2022. There aren’t any modifications from the prior month aside from a reshuffling within the order of greatest ranked shares. The information proven within the picture beneath is as of 6/30/22.

Created by Creator

All 10 chosen shares this month look like probably undervalued based mostly on dividend yield principle. Nevertheless the potential undervaluation for Advance Auto Elements (AAP) is deceptive due to the very quick dividend development in the course of the previous couple years. I consider the corporate appears engaging at its present valuation however it isn’t 85% undervalued as dividend yield principle suggests.

The anticipated fee of return proven within the final column is computed by taking the present dividend yield plus a return to honest worth over the subsequent 5 years and a reduced long run earnings forecast.

Please remember the fact that my return forecasts are based mostly on assumptions and must be seen as such. I’m not anticipating that these 10 corporations will hit the forecasted returns. What I do anticipate is that these 10 corporations have the potential to supply higher returns in the course of the subsequent 5 years in comparison with the 31 excessive yield shares that handed my preliminary filters however ranked worse on high quality and valuation.

Previous Efficiency

The June watchlist misplaced 10.24% final month bringing the year-to-date return for the watchlist to minus 13.81%. For comparability functions VYM, Vanguards excessive yield ETF, is down 7.97% this 12 months and SPY, S&P 500 ETF, is down 19.98%. Following the poor leads to June the annualized return for the watchlist falls from 24.36% to fifteen.29%. The hole to VYM widens from 2.83% to 4.35% (annualized return is nineteen.64%). And the hole to SPY shrinks type 6.83% to only 4.58%. I don’t anticipate that this watchlist beat VYM or SPY each month, nonetheless, I consider {that a} buy-and-hold investing strategy leveraging the shares offered on this watchlist will generate long run alpha in comparison with the broad market. I even have a private goal fee of return of 12% that I consider might be attained by this watchlist when measured over lengthy durations of time.

Up to now the watchlist has exceeded my expectations and I consider it should proceed to take action in the long term.

|

Date |

Watchlist |

ALL |

VYM |

SPY |

|

6 month |

-13.81% |

-7.63% |

-7.97% |

-19.98% |

|

3 month |

-14.95% |

-9.34% |

-8.62% |

-16.11% |

|

1 month |

-10.24% |

-8.04% |

-7.86% |

-8.25% |

|

YTD |

-13.81% |

-7.63% |

-7.97% |

-19.98% |

|

Since Inception |

26.76% |

37.57% |

34.83% |

18.48% |

|

Annualized |

15.29% |

21.09% |

19.64% |

10.71% |

Particular person watchlist returns for June 2022 had been:

- (UPS) +0.16%

- (QSR) -3.43%

- (DLR) -6.08%

- (AAP) -8.01%

- (BLK) -8.31%

- (TROW) -9.61%

- (MS) -11.70%

- (MMM) -13.32%

- (BBY) -19.55%

- (BX) -22.55%

Prime 5 Shares by complete return since becoming a member of the watchlist:

- (PFG) +82.18% (20 months)

- (GD) +75.74% (20 months)

- (CVS) +71.14% (20 months)

- (BMO) +70.99% (20 months)

- (MTB) +62.10% (20 months)

PFG misplaced 7.6% in June however holds on to first place. GD misplaced 1.07% in June however jumps into the second place in flip knocking out TD from the highest 5 checklist. CVS misplaced 4.23% in June however strikes up from fifth to third place surpassing MTB and BMO. BMO, the long run chief, drops once more after June falling into 4th place after shedding 11.68% in the course of the month. MTB misplaced 11.44% in June and slides down into fifth place.

Prime 5 Shares by Common Month-to-month return since becoming a member of the watchlist:

- (ATO) +3.32% (7 months)

- (PFG) +3.04% (20 months)

- (GD) +2.86% (20 months)

- (CVS) +2.72% (20 months)

- (BMO) +2.72% (20 months)

Purchase-And-Maintain Portfolios

The buy-and-hold portfolios are a extra helpful measure of how a long run investing strategy using this watchlist may carry out. I began monitoring one for 2022 and one since 2021. Each buy-and-hold portfolios make investments an equal quantity every month into all 10 chosen excessive yield shares, the positions are by no means offered and all dividends are reinvested again into the issuing inventory.

This is a fast breakdown of how every portfolio is performing.

The 2021 buy-and-hold portfolio has now been round for 18 full months. It misplaced 9.13% in June, underperforming each VYM and NOBL. Despite this loss, the portfolio maintains cumulative alpha of three.71% over VYM and 16.82% over SPY. On an annualized foundation the portfolio has a return of 12.83% in comparison with 10.49% for VYM and a couple of.01% for SPY.

|

TOTAL |

Cumulative |

2021 |

2022 |

Annualized |

|

2022 B&H |

19.86% |

32.97% |

-9.86% |

12.83% |

|

VYM |

16.15% |

26.21% |

-7.97% |

10.49% |

|

SPY |

3.03% |

28.76% |

-19.98% |

2.01% |

It’s now made up of 42 distinctive excessive yield dividend shares. Under is a desk of the entire positions, the cumulative return for every part and the allocation as of June 30, 2022.

|

Image |

Return |

Alloc. |

|

AAP |

-12.52% |

1.98% |

|

AMGN |

10.33% |

6.86% |

|

ATO |

25.67% |

0.71% |

|

AVGO |

3.02% |

3.49% |

|

BBY |

-28.65% |

2.42% |

|

BEN |

-28.82% |

0.40% |

|

BK |

1.52% |

0.57% |

|

BLK |

-5.05% |

1.07% |

|

BMO |

-7.73% |

1.04% |

|

BX |

-19.98% |

1.36% |

|

CMI |

-4.50% |

0.54% |

|

CMA |

2.14% |

1.73% |

|

CMS |

14.11% |

1.29% |

|

CSCO |

-17.31% |

0.93% |

|

DLR |

-6.46% |

2.11% |

|

DRI |

-20.85% |

2.24% |

|

DTE |

18.31% |

2.00% |

|

EPD |

5.15% |

1.19% |

|

EVRG |

8.99% |

3.08% |

|

GD |

55.65% |

1.76% |

|

HBAN |

1.42% |

0.57% |

|

INTC |

-21.91% |

0.44% |

|

JPM |

-8.82% |

1.03% |

|

LMT |

26.48% |

5.00% |

|

MMM |

-24.38% |

6.83% |

|

MS |

-16.58% |

4.24% |

|

MTB |

12.79% |

5.10% |

|

NTRS |

8.41% |

1.84% |

|

PEP |

18.41% |

2.68% |

|

PFG |

14.77% |

5.19% |

|

PGR |

36.99% |

1.55% |

|

PM |

10.37% |

4.99% |

|

QSR |

-10.66% |

4.54% |

|

RY |

8.84% |

3.07% |

|

SNA |

-4.12% |

0.54% |

|

STT |

-10.56% |

1.52% |

|

TD |

4.14% |

5.29% |

|

TFC |

-15.74% |

1.90% |

|

TROW |

-17.01% |

2.34% |

|

UPS |

-6.05% |

2.12% |

|

USB |

-10.95% |

1.51% |

|

PARA |

-17.60% |

0.93% |

The 2022 buy-and-hold portfolio carried out worse in June shedding 10.48%. The portfolio trails VYM by 4.62% after 6 months however is outperforming SPY by 7.39%. I consider the portfolio will catch-up with VYM and provide alpha in the long term.

|

TOTAL |

Cumulative |

|

2022 B&H |

-12.59% |

|

-7.97% |

|

|

-19.98% |

As of month finish June it contains 23 distinctive excessive yield dividend shares. Under is a desk of the entire positions, the cumulative return for every part and the allocation as of June 30, 2022.

|

Image |

Return |

Alloc. |

|

AAP |

-12.52% |

6.66% |

|

AMGN |

9.42% |

4.16% |

|

BBY |

-28.65% |

8.15% |

|

BEN |

-28.82% |

1.35% |

|

BLK |

-5.05% |

3.61% |

|

BMO |

-14.74% |

1.62% |

|

BX |

-19.98% |

4.57% |

|

CMI |

-4.50% |

1.82% |

|

DLR |

-6.46% |

7.12% |

|

EPD |

-3.91% |

1.83% |

|

LMT |

22.53% |

2.33% |

|

MMM |

-16.21% |

7.97% |

|

MS |

-15.26% |

9.68% |

|

MTB |

5.15% |

2.00% |

|

PM |

6.69% |

2.03% |

|

QSR |

-8.98% |

8.66% |

|

RY |

-14.32% |

1.63% |

|

SNA |

-4.12% |

1.82% |

|

TD |

-15.11% |

3.23% |

|

TROW |

-17.01% |

7.90% |

|

UPS |

-6.05% |

7.15% |

|

USB |

-18.29% |

3.11% |

|

PARA |

-16.90% |

1.58% |

Two advantages these portfolios provide over VYM and SPY are a better beginning dividend yield and a extra spaced out dividend payout schedule. The 2021 buy-and-hold portfolio is performing very effectively up to now and the 2022 portfolio hasn’t been round lengthy sufficient to be correctly evaluated.

I consider {that a} buy-and-hold investing strategy is one of the best technique for all dividend traders. For those who apply this technique concentrating on high quality corporations buying and selling for engaging costs you’ll obtain higher than common leads to the long term.

from Top Stock To Invest – My Blog https://ift.tt/yk29uGm

via IFTTT

No comments:

Post a Comment