Shares fell barely Wednesday in uneven buying and selling as markets struggled to maintain a rebound from earlier within the day.

Merchants additionally weighed feedback from Federal Reserve Chair Jerome Powell, who reiterated the central financial institution’s stance to struggle inflation.

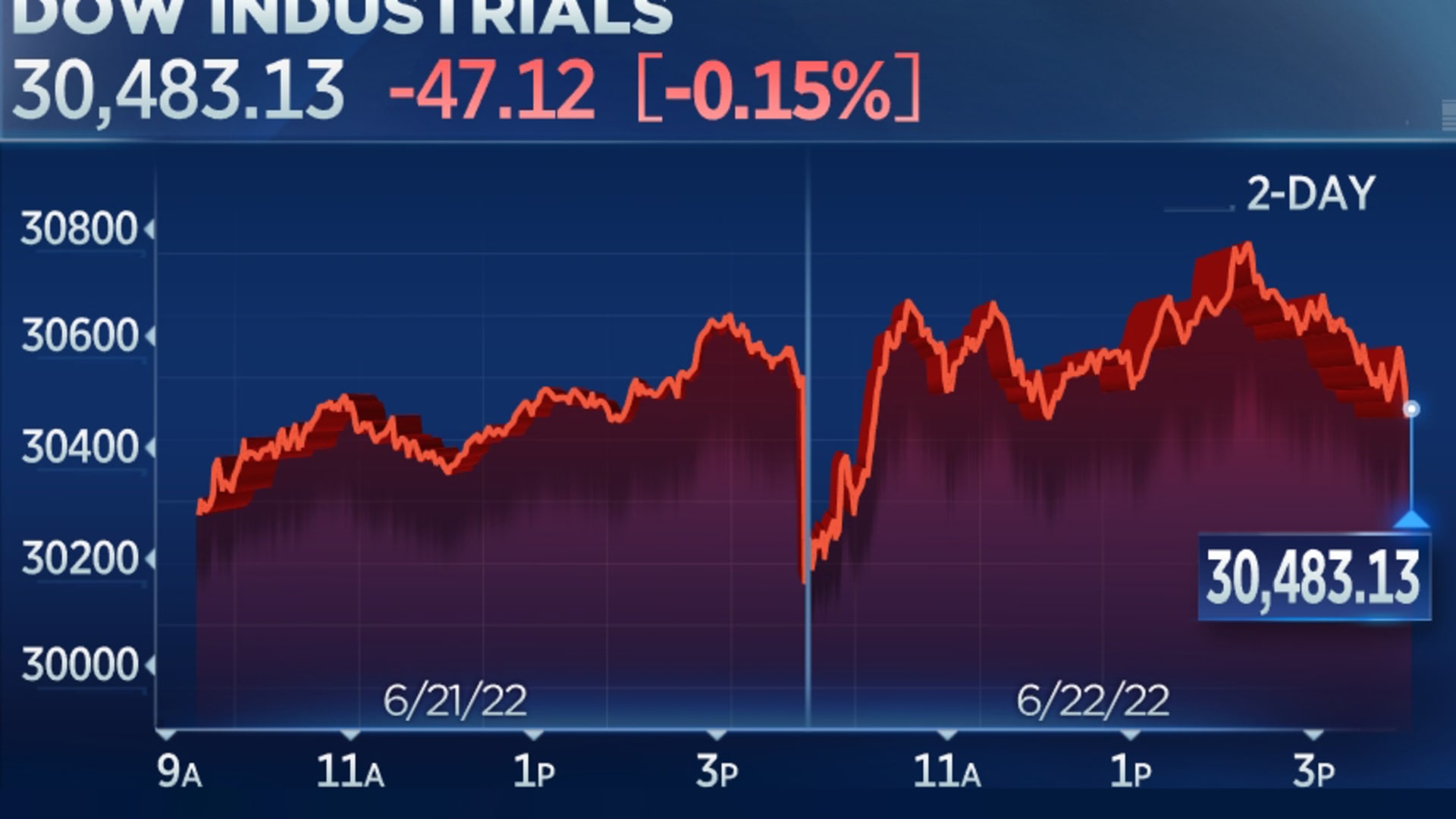

The Dow Jones Industrial Common dropped 47.12 factors, or 0.15%, to 30,483.13, slipping within the ultimate hour of buying and selling. The S&P 500 dipped 0.13% to three,759.89. The Nasdaq Composite fell 0.15% to 11,053.08.

Rising considerations of a recession on Wall Road have lately weighed on shares. Fed Chair Powell on Wednesday informed Congress the central financial institution has the “resolve” to tame inflation that has surged to 40-year highs.

“On the Fed, we perceive the hardship excessive inflation is inflicting,” the Fed chief mentioned to the Senate Banking Committee. “We’re strongly dedicated to bringing inflation again down, and we’re shifting expeditiously to take action.”

Powell added that the Fed will keep the course till it sees “compelling proof that inflation is shifting down.” He additionally mentioned reaching a tender touchdown for the economic system with out a recession has change into “considerably more difficult.”

The Federal Reserve raised charges by 0.75 share level final week and hinted one other enhance of that magnitude was doable subsequent month. The central financial institution’s shift final week to a extra aggressive inflation-fighting stance unnerved traders who frightened the central financial institution would quite threat a recession than endure persistent excessive inflation.

“Inflation stays the most important threat to monetary property, and Jerome Powell has made his place abundantly clear: The Fed will proceed to lift rates of interest till inflation begins to wane. Till then, a sustainable rally for threat property is tough to think about,” wrote Robert Schein, chief funding officer of Blanke Schein Wealth Administration.

“Tight financial circumstances will proceed to be a headwind to monetary markets till the Fed provides the greenlight,” Schein continued.

Recession considerations

Expectations of a pending recession continued to develop on Wall Road this week. Citigroup raised chances of a global recession to 50%, pointing to information that buyers are beginning to pull again on spending.

“The expertise of historical past signifies that disinflation usually carries significant prices for progress, and we see the mixture chance of recession as now approaching 50%,” learn a word from Citigroup.

Goldman Sachs believes a recession is becoming increasingly likely for the U.S. economic system, saying that the dangers are “increased and extra front-loaded.”

“The principle causes are that our baseline progress path is now decrease and that we’re more and more involved that the Fed will really feel compelled to reply forcefully to excessive headline inflation and shopper inflation expectations if power costs rise additional, even when exercise slows sharply,” the agency mentioned in a word to shoppers.

In the meantime, UBS mentioned Tuesday in a word to shoppers that it doesn’t anticipate a U.S. or world recession in 2022 or 2023 in its base case, “nevertheless it’s clear that the dangers of a tough touchdown are rising.”

“Even when the economic system does slip right into a recession, nonetheless, it must be a shallow one given the energy of shopper and financial institution stability sheets,” UBS added.

Power shares took successful as oil costs dropped on concern a slower economic system will harm gas demand. The sector was the worst-performing on the broad market index, down 4.2%.

Shares of Marathon Oil and ConocoPhillips dropped 7.2% and 6.3%, respectively. Occidental Petroleum and Exxon Mobil dipped 3.6% and practically 4%.

On Wednesday, President Joe Biden known as for Congress to suspend the federal gas tax for 3 months. The hassle is supposed to ease pressures on the pump for shoppers throughout an election yr.

from Stock Market News – My Blog https://ift.tt/XcZPY8N

via IFTTT

No comments:

Post a Comment