The breakdown in S&P 500 with spike of quantity on 13 June 2022 adopted by a weak rally up after the Fed’s FOMC pointed to the bearish situation. The present market growth is much like the worldwide monetary disaster in 2008 when it comes to each value construction and the market rotation sequence as defined within the video on the backside of this submit.

Utilizing Wyckoff Methodology to Spot the Silver Lining

After a greater than 10% drop in 6 buying and selling periods, S&P 500 is correct at a weak spot the place a inventory market crash might simply be triggered. Over the weekend, Bitcoin broke beneath the help at 20000 steered a continuation of the risk-off mode into the approaching week.

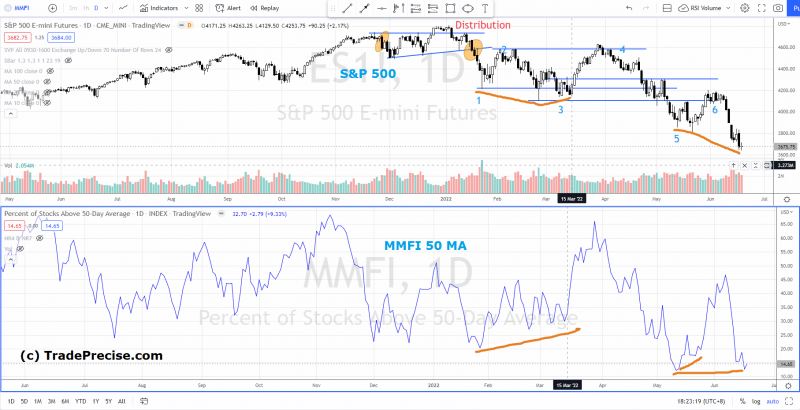

Nevertheless, there may be nonetheless a silver lining for the looming inventory market crash when adopting the Wyckoff trading method to identify the tell-tale indicators for a possible short-term rally. Seek advice from the chart beneath.

Because the breakdown of the short-term help at 4080 on 9 Jun 2022, shortening of the thrust to the draw back was noticed (as annotated in blue) together with lowering of the amount steered exhaustion of the down momentum.

S&P 500 is at present testing the oversold line of the down channel, which might susceptible to a reduction rally out from the oversold situation. The rebound off the channel oversold line occurred prior to now on 24 January 2022, 24, February 2022 and 20 Could 2022.

The 2 value targets based mostly on the Level and Determine chart are 3900 adopted by 3650. In Could 2022, after the primary value goal of 3900 was hit, S&P 500 stopped the down transfer and consolidated for one month. The fulfilment of the second value goal at 3650 gives a situation for S&P 500 to try to rally when decoding with the technical particulars as defined above.

Even when S&P 500 begins to rally up as illustrated within the inexperienced path, it’s essential to observe how the worth reacts on the key ranges akin to 3800 adopted by the hole resistance zone close to 3900 (annotated in pink line). Any failure alongside the best way might sign the tip of the rebound and the start of an impulsive down transfer.

Ought to the short-term rebound fail to materialize, a break beneath the current low at 3640 and a dedication beneath the oversold line of the down channel might set off a capitulation, which might result in a stock market crash much like 2008’s scenario as detailed within the video on the backside of this submit.

Bullish Divergence Between S&P 500 and The Market Breadth

A bullish divergence between S&P 500 and the market breadth (p.c of shares above 50-day common) was noticed, as proven within the chart beneath.

A bullish divergence was noticed close to finish of January 2022 until mid of March 2022 (annotated in orange) the place the market breadth shaped the next low whereas S&P 500 shaped a decrease low. Subsequently a robust rally kicked begin after the bullish divergence.

Equally, between 12-20 Could 2022, a bullish divergence was shaped adopted by a reduction rally examined the resistance zone close to 4200.

Now, a possible bullish divergence is unfolding from Could until now. A significant rally in S&P 500 would mark the third profitable bullish divergence.

Inventory Market Crash Comparability 2022 vs 2008

When the silver lining fails alongside the best way and even initially, S&P 500 is more likely to enter into market crash mode much like the worldwide monetary disaster in 2008.

Watch the video beneath to search out out the similarities of the inventory market crash in 2008 from the worth construction to the market rotation sequence.

The signal of weak point within the power sector (XLE) began final week additional strengthened this market crash analogue. Visit TradePrecise.com to get extra inventory market insights in e-mail totally free.

This article was initially posted on FX Empire

Extra From FXEMPIRE:

from Stock Market News – My Blog https://ift.tt/EWzdUg8

via IFTTT

No comments:

Post a Comment